The performance quoted may be before charges, which will reduce illustrated performance.Please ensure that you fully understand the risks involved. Let’s go over some examples of some gravestone doji formations and how they emerge and how they can be used as reversal signals. The gravestone doji can emerge anywhere during a trend which is due to the buyers and sellers indecisiveness of where they want to take the market.

- We can see the In this stage of the candlestick pattern, the bears have pushed the price down all the way to the OPEN of the candlestick.

- Each day our team does live streaming where we focus on real-time group mentoring, coaching, and stock training.

- Dojis are trend reversal indicators, especially if they appear after an uptrend or downtrend.

- Once a candle closes below this level, you can open a short position.

- The idea here is to trade pullbacks to the moving average when the price is on a downtrend.

- It is valid to note that the Doji pattern does not necessarily mean that there will always be a trend reversal.

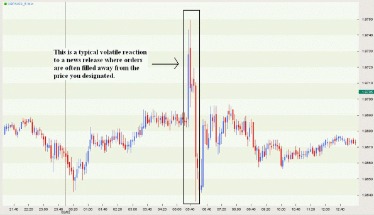

HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. The example below shows how the bearish gravestone Doji forms at the top of a trend and signals a selling opportunity. To confirm the pattern’s bearish reversal signal, we used RSI and MACD – two of the most popular and effective momentum indicators.

Get TrendSpider Apps

Assuming these confirm a bullish breakout, traders will want to close out shorts and open long positions. However, it is worth nothing that not all gravestone doji patterns are usually a sign that a bearish reversal is about to happen. Especially when combined with multiple reversal patterns and confirmation candles, these doji’s can be used to help traders pick the best entries and exits to their long and short positions. Candlestick charts are great for providing decision support to technical indicators and chart patterns.

Analysis: What Christmas Day of 2022 has for Bitcoin in store? – Finbold – Finance in Bold

Analysis: What Christmas Day of 2022 has for Bitcoin in store?.

Posted: Mon, 19 Dec 2022 08:00:00 GMT [source]

Gravestone Doji is a candlestick in which the open and close price of the candle is at the same level or are very close on the same level. With a 3-day holding period (right table), the pattern also did poorly. The pattern produced an average loss of -0.52% in our 21 markets with an average win rate of 42%. In stocks, the strategy did even worse with an average loss of -0.31% and an average win rate of 44%. However, the Gravestone Doji is characterized by the presence of the body as a line, indicating an opening and closing price that are near-identical. In this case, the Gravestone Doji also came after an evident bearish trend.

How to Trade Gravestone Doji Candlesticks

Statistical expectancy may be improved by combining with certain trend filters, such as a moving average. An example showing how to combine additional technical indicators with candlestick patterns available here. It should have a narrow body with a long upper shadow and small or non-existent lower shadow. The longer the upper shadow, the stronger the reversal signal is.

The deviation type, multiplier and swing strength requirement is user selectable via the indicator dialogue box. For the swing strength, the current bar’s low will mark a new N bar low, by default set to 5. Likewise, the upper shadow is set to be x times larger than the body size and the lower shadow, by default a factor of 3. It represents a bearish pattern during a reversal that will be followed by a downtrend in price. Traders can use the pattern to determine when to take profits—either through a bearish trade or on a bullish position. The main difference between these two candles is that the gravestone doji’s open, close and low prices should be equal while the inverted hammer should have a so-called real body.

Gravestone Doji: Discussion

We’re also a community of traders that support each other on our daily trading journey. A Gravestone Doji signals that the price opened at the low of the session. There was a great rally during the session, and then the price closed at the low of the session. Yet, as we mentioned earlier, you must confirm the gravestone pattern with other indicators to maximize the chances of success and know exactly where to enter and exit the position. The long upper shadow is generally interpreted by technicians as meaning that the market is testing to find where supply and potential resistance is located.

At the top of this article, reading candlesticks and using them to identify chart patterns may have been a completely foreign concept. But now, you’re probably starting to realize it’s actually pretty simple! Dragonfly doji can also be used to confirm bullish uptrends in the following chart showing the S&P 500 SPDR (SPY) at a different point in time. In this case, traders looking for an entry point into the uptrend could have used the dragonfly doji as a confirmation that the uptrend would continue. As the name implies, imagine looking at the side profile of an actual gravestone.

How To Identify The Gravestone Doji Candlestick Pattern

A gravestone doji is a trading pattern that occurs in technical analysis. It is a bearish trend that indicates a reversal is on the horizon. Traders can assume that the reversal will be accompanied by a downtrend in the security’s price. When a trader identifies a gravestone doji, they may be able to profit on a bullish position or by taking a position on a bearish trade. As shown above, the gravestone doji pattern forms when a candlestick has a long upper shadow and a small body at the lower side.

- The long upper shadow is generally interpreted by technicians as meaning that the market is testing to find where supply and potential resistance is located.

- Another difference is that the gravestone doji is considered as a bearish reversal pattern.

- For the gravestone doji, we have devised a method for how to set profit targets for when to exit the trade.

- Watch our free 7-minute tutorial on how pro traders harness unusual option activity.

The image starts with a price increase, followed by a bearish reversal gravestone doji. A Gravestone Doji is a more restrictive version of the shooting star pattern. It has a long upper shadow, little or no lower shadow and a doji forming near the bar low. A Gravestone Doji is therefore a pattern that forms when prices advance significantly, but then retreats to close near the initial open. In the first table on the left we can see the results of shorting a gravestone doji pattern on the close and holding the trade for one whole day. Essentially, he would not enter his trade until the candlestick that followed the Gravestone Doji has fully confirmed its close under the open of the Gravestone candlestick pattern.

Gravestone doji vs dragonfly doji

To remember Gravestone and Dragonfly Doji shape and pattern, this is better to imagine how a dragonfly or a grave shape is. A Gravestone Doji candle forms when the Open, Low and Close price of a candle are same or about the same price. Here we talk about what is a Gravestone Doji, how Gravestone Doji forms gravestone doji candlestick and how to trade it correctly and with well-managed risk. Cant wait for you to update your Udemy courses with more trend following and momentum strategy. Was pretty amaze by the reversal percentage according to his backtest. It will be extremely useful for technical users if you are able to validate them.

A Doji is formed when the opening price and the closing price of an asset are the same. A long-legged Doji, also known as a “Rickshaw Man,” is a Doji whose upper and lower shadows are much longer than the regular Doji formation, as shown in the image below. This pattern indicates the market’s indecision about pricing direction. Once you’ve mastered the basics, you’ll be able to develop your own style. Therefore, it is always a good idea not to take gravestone doji as a stand-alone signal. With some cross-checks mentioned above or some specific trading approaches mentioned in the trading strategies, the power of the generated signals could be significantly improved.

In the example above, you can see that the candlestick pattern formed precisely, and the market reversed as expected. This opens up to two types of selling signals, a weak signal, and a strong signal based on where the patterns appear. For example, if you saw a gravestone doji on a 1-week chart, that will provide a stronger indication of a reversal, much more than a gravestone doji appearing on a 15-minute chart. A stock that closes higher than it opens will always be green. For this particular candelstick pattern, we have devised a method for how to set profit targets for when to exit the trade.